A lot of companies, including a large portion of Silicon Valley startups, grant new hires immediately exercisable ISOs (incentive stock options) with the expectation that many will exercise their options “early” for favorable tax treatment. In fact, employees are often given a kit with all the paperwork, including everything needed to exercise and file an 83(b) election with the IRS.

In general, this is a nice offer. ISOs are generally more favorable to employees than nonqualified or nonstatutory stock options (“NQOs,” also called “NSOs”). And the opportunity to immediately exercise the options, receive the shares (subject to vesting), and make an 83(b) election is generally thought to mean the start of the capital gains holding period.

The primary benefit of an ISO is that on exercise, an employee does not have ordinary income when there is a “spread” on exercise (meaning, on exercise the fair market value of the stock exceeds the strike price).

The ISO exclusion from ordinary income tax also extends to employment taxes on the spread. And any spread is also not subject to the new Medicare surtaxes that were part of Obamacare, which impose an additional 3.8% tax on gains from stock that are considered “net investment income” in excess of certain thresholds.

If you are familiar with the math, income and employment taxes on the receipt of illiquid stock of your employer can be a huge financial burden that you may not have the ability to pay. (This is why employees frequently say, in response to an offer from an employer of high-value company stock, “No, I don’t want your stock. I can’t afford it.”) This is why options are so helpful–with an option you can defer the tax until you exercise (an event typically within the optonee’s control).

So, an offer of an immediately exercisable ISO is a reasonable approach to equity compensation, and should be appreciated for its advantages. We’re not here to knock the Silicon Valley way. But there is another fact most people miss.

Immediately Exercisable ISOs: Not Always Ideal

If you plan to exercise your options immediately (that is, immediately upon receipt), you would be better off if the option were an NQO rather than an ISO.

Why? How would an immediately exercisable option be better for you if set up as an NQO than an ISO? Well, like everything with ISO taxation, it’s complicated.

Firstly, it’s worth remembering the well-known “AMT trap,” where you sometimes have to pay taxes at time of exercise anyway, not as ordinary income tax, but in the form of AMT. As a reminder, when you exercise your ISO, even though you will have no ordinary income on exercise, the spread will be considered an AMT adjustment. This AMT tax event can be a big problem, particularly since the private stock probably can’t be sold to pay the possibly large tax bill. During the first dotcom boom, this tax trap drove a number of people into bankruptcy. The problem got so bad Congress passed a one-time forgiveness.

However, the usual AMT trap isn’t an issue for immediately exercisable options granted to new employees, where the strike price and fair market are likely the same—when the employee intends to exercise immediately.

Differing Holding Period Requirements

The issue to worry about here is a second and more subtle factor to do with holding periods to get more favorable long-term capital gains tax rates. The basic holding period requirements for ISOs and NQOs are different:

- ISO: To get long-term capital gains on the exercise of an ISO, you have to hold the shares for two years from the date of grant of the option until sale, and at least one year from the date of exercise until sale. In other words, you have a two-year holding period if you plan to immediately exercise.

- NQO: If you receive an immediately exercisable NQO, and exercise it immediately, you will have no income and employment taxes due because the strike price equals the fair market value. And if you file your 83(b) election, you will then start your capital gains holding period. And on an NQO, you only have to hold the shares for longer than one year to get long term capital gains treatment, not two.

Waiting two years is worse than waiting one. But to make matters worse, there are technicalities about ISOs that can make it even harder to meet the long-term capital gains holding period than the two years you’d expect. Many people believe early exercise together with an 83(b) election will start the clock sooner and help them hold the stock longer, to qualify for long-term capital gains. While this is true for NQOs, it’s not true for ISOs.

The IRS rules on ISOs say that the 83(b) election is valid only for AMT purposes — not for ordinary income tax purposes. What this means is that if you make a disqualifying disposition, then your capital gains holding period for ordinary income tax purposes does not start until the shares actually vest (see Example 2 in Treas. Reg. §1.422-1(b)(3), quoted in its entirety below). If you timely make an 83(b) election on early exercise of an ISO, the election works for ISO and AMT purposes. This means that if there is no disqualifying disposition, and you meet your holding period requirements, and the other ISO qualifications, you start your capital gains holding period on exercise, not on vesting.

So, if you want to immediately exercise an option and file an Section 83(b) election, it’s better if you can have it be an NQO. If you ask your employer to make your option grant an NQO, your employer should be able to accommodate you. And if you’re a founder or CFO, you might want to consider if this is the right choice for early employees in your company.

Some Rules of Thumb

We would offer the following rules of thumb:

- If you can choose between an immediately exercisable ISO and an immediately exercisable NQO, and you plan to exercise right away—you should choose the immediately exercisable NQO.

- If you can choose between an immediately exercisable ISO and an immediately exercisable NQO, and you don’t know if you are going to exercise right away, the question becomes more difficult. In general, in this scenario—choose the ISO.

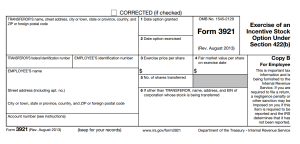

Below are examples from the Treasury Regulations which show the IRS’s view on immediately exercisable ISOs. The IRS takes the view that since there is no ordinary income on the exercise of ISO, an 83(b) election with respect to an ISO can’t have any effect on the tax outcome, and the election is only effective for AMT purposes.

Of course, it would be nice if Congress fixed this whole mess. Indeed, if Congress really cared to remove perverse penalties from the tax code, it would simply repeal income and employment taxes on the receipt of illiquid stock altogether. It is not as if you can sell the stock to pay the taxes. You can’t do anything with the stock (and if your high-risk startup tanks, it’s ultimately worth little or nothing). In fact, thanks to the securities laws, you have to represent and warrant that you plan to hold the shares “indefinitely” for “investment purposes.” In other words, you pay your taxes… on illiquid shares… that you represent you will hold forever.

But we digress. None of those tax code changes are likely soon. So in the meantime, if you receive an immediately exercisable ISO, and you plan to exercise right away, consider asking that it be an NQO, not an ISO.

Examples from the Treasury Regulations at 1.422-1:

Example 1. Disqualifying disposition of vested stock.

On June 1, 2006, X Corporation grants an incentive stock option to A, an employee of X Corporation, entitling A to purchase one share of X Corporation stock. On August 1, 2006, A exercises the option, and the share of X Corporation stock is transferred to A on that date. The option price is $100 (the fair market value of a share of X Corporation stock on June 1, 2006), and the fair market value of a share of X Corporation stock on August 1, 2006 (the date of transfer) is $200. The share transferred to A is transferable and not subject to a substantial risk of forfeiture. A makes a disqualifying disposition by selling the share on June 1, 2007, for $250. The amount of compensation attributable to A’s exercise is $100 (the difference between the fair market value of the share at the date of transfer, $200, and the amount paid for the share, $100). Because the amount realized ($250) is greater than the value of the share at transfer ($200), paragraph (b)(2)(i) of this section does not apply and thus does not affect the amount includible as compensation in A’s gross income and deductible by X. A must include in gross income for the taxable year in which the sale occurred $100 as compensation and $50 as capital gain ($250, the amount realized from the sale, less A’s basis of $200 (the $100 paid for the share plus the $100 increase in basis resulting from the inclusion of that amount in A’s gross income as compensation attributable to the exercise of the option)). If the requirements of section 83(h) and § 1.83-6(a) are satisfied and the deduction is otherwise allowable under section 162, for its taxable year in which the disqualifying disposition occurs, X Corporation is allowed a deduction of $100 for compensation attributable to A’s exercise of the incentive stock option.

Example 2. Disqualifying disposition of unvested stock.

Assume the same facts as in Example 1, except that the share of X Corporation stock received by A is subject to a substantial risk of forfeiture and not transferable for a period of six months after such exercise. Assume further that the fair market value of X Corporation stock is $225 on February 1, 2007, the date on which the six-month restriction lapses. Because section 83 does not apply for ordinary income tax purposes on the date of exercise, A cannot make an effective section 83(b) election at that time (although such an election is permissible for alternative minimum tax purposes). Additionally, at the time of the disposition, section 422 and § 1.422-1(a) no longer apply, and thus, section 83(a) is used to measure the consequences of the disposition, and the holding period for capital gain purposes begins on the vesting date, six months after exercise. The amount of compensation attributable to A’s exercise of the option and disqualifying disposition of the share is $125 (the difference between the fair market value of the share on the date that the restriction lapsed, $225, and the amount paid for the share, $100). Because the amount realized ($225) is greater than the value of the share at transfer ($200), paragraph (b)(2)(i) of this section does not apply and thus does not affect the amount includible as compensation in A’s gross income and deductible by X. A must include $125 of compensation income and $25 of capital gain in gross income for the taxable year in which the disposition occurs ($250, the amount realized from the sale, less A’s basis of $225 (the $100 paid for the share plus the $125 increase in basis resulting from the inclusion of that amount of compensation in A’s gross income)). If the requirements of section 83(h) and § 1.83-6(a) are satisfied and the deduction is otherwise allowable under section 162, for its taxable year in which the disqualifying disposition occurs, X Corporation is allowed a deduction of $125 for the compensation attributable to A’s exercise of the option.

This blog post does not constitute legal advice or the establishment of an attorney-client relationship. In all instances you should consult your own attorney or tax advisor with respect to the facts of your particular situation.

By Joshua Levy and Joe Wallin