You have an idea for a new startup. One of your first google searches will probably be about how/where to incorporate your business. There’s some good advice out there and some bad advice out there. In the interest of cutting through the noise, here’s the advice we typically give our clients.

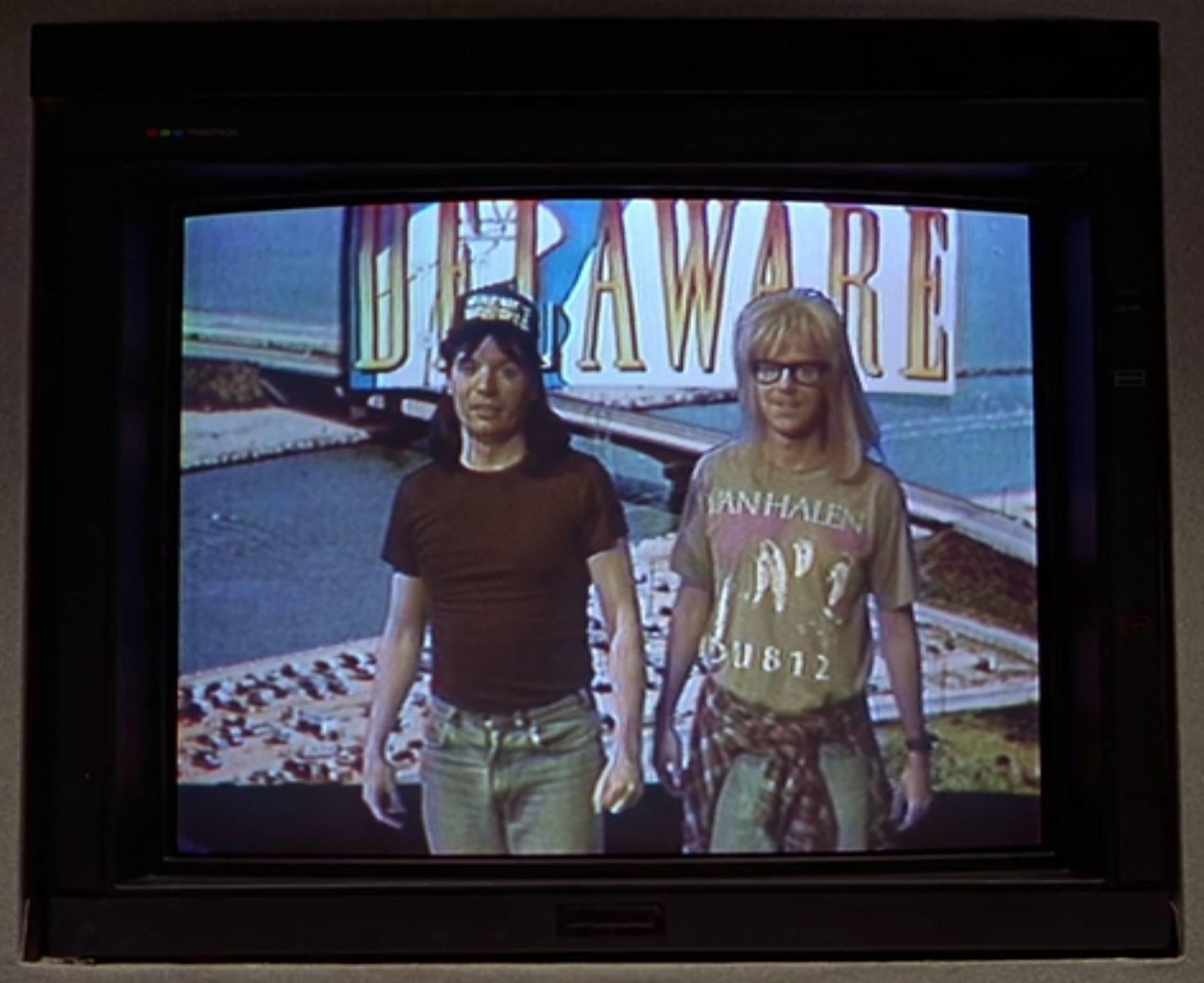

Welcome to Delaware

If you’re a high growth startup and plan on taking investment from angel investors and VCs, Delaware is the safe choice.

Here’s why Delaware is great:

- No one will ever ask, and you will not have to begrudgingly answer, "Why didn't you incorporate in Delaware?"

- A lot of the standard form documents that are available on the web and are widely accepted in startup circles (see, e.g., the Series Seed documents and the NVCA document suite), are prepared for Delaware corporations.

- If you’re already in Delaware, you can't be forced to reincorporate in Delaware by some pushy investor. This is what we in the biz call a 4-dimensional chess move.

- If you move your company, Delaware is pretty portable. Every state’s major commerce center has lawyers who know and can work with Delaware corporate law, so you’ll never have to worry about finding a new lawyer.

- There are certain provisions of Delaware law that are more favorable to company management than many other state laws.

- Delaware has a separate court system dedicated to corporate disputes, and Delaware corporate law is updated more often than the corporate laws of other states.

Here’s the short list of cons for Delaware:

- It’s generally more expensive in terms of fees and taxes.

- You’ll invariably get a franchise tax bill for some absurd amount of money payable to Delaware in your first year. While heart attack inducing, this usually isn’t a big deal, and there’s an alternate calculation method (on the back of the notice that you just threw across the room) that you can use to get the tax way down to a couple hundred/thousand bucks.

Visit Washington

While we work with and form a ton of Delaware companies, we are located in Seattle, Washington. Washington is actually a pretty solid place to form a company. Here’s why:

- It is less expensive to form and maintain a Washington corporation (the annual fee to keep your corporation alive in Washington is just a little over $100 a year; Delaware starts higher, and the costs of Delaware go up over time relative to the costs of being incorporated in Washington. It costs less in third party fees to dissolve a Washington corporation.

- Washington corporate law is substantially similar to Delaware law, and in the event of any litigation, Washington courts would likely look to Delaware court opinions as persuasive authority.

- If you run into a complex question of corporate law and you are incorporated in Delaware, you may have to retain a law firm in Delaware to assist you. This will probably wind up being more expensive than continuing to work with a Washington corporate lawyer.

- Investors are generally pretty okay with Washington - we haven’t had much issue with investors insisting a Washington company converts to Delaware (though with one exception being accelerators like Techstars and Y Combinator). Microsoft is a Washington corporation, and it never held it back.

Other States

Here’s where some of the bad online advice comes in. A number of people will float states like Montana, Nevada, or Wyoming. There are some benefits to incorporating in states like this depending on where you ultimately go, like not seeing who the owners of a corporation are, lower taxes, wide-open spaces, etc. That said, there’s a litany of issues with these states (see “why not Delaware” and “what do you mean there’s no attorneys that know how to interface with Wyoming corporations in San Francisco?”). Incorporating in states like these should only be done if you have some sort of special requirement, and after talking with a lawyer and an accountant that agree that there’s some benefit with going to a more “exotic” state.

There are other states out there, like New York, that are “review states.” This means that every time you need to do a charter filing or other state filing, you have to barter with some attorney on staff at the state (whereas in Washington and Delaware, there is no process like this - you file, and your filing is accepted immediately). Because of this, incorporating in review states typically results in hair loss and melancholy, especially if you’re trying to close a transaction or financing which requires a charter amendment.

Conclusion

I just want to say that I’m not trying to bag on the corporate jurisprudence of other states. If you’re planning on creating a bootstrapped company that’s going to throw off cash on day one and will never leave your state of incorporation, you can probably do whatever you want. If for whatever reason, you grow out of a state, most of the time, it’s not too painful to convert elsewhere (unless you incorporate in a review state... ick, or someplace without a conversion statute).

In any event, I hope this was helpful. If you’re looking to set up your startup in Delaware, or if you want to walk on the wild side and give the beautiful state of Washington a try, we’re happy to help, and always feel free to contact me.

By: Bryant Smick

For more articles like this, please visit, here.

Carney Badley Spellman is about Advocacy, Strategy, Results. Located in Seattle, we are a full-service law firm committed to exceptional client service and professional excellence. Our firm serves individuals and businesses of all types and sizes. Also, our attorneys work with closely-held companies to Fortune 500 corporations in the Pacific Northwest and across the United States. Although Carney Badley Spellman's location is in Seattle, Washington, we are proud to be a part of the Washington state community and communities across the nation.